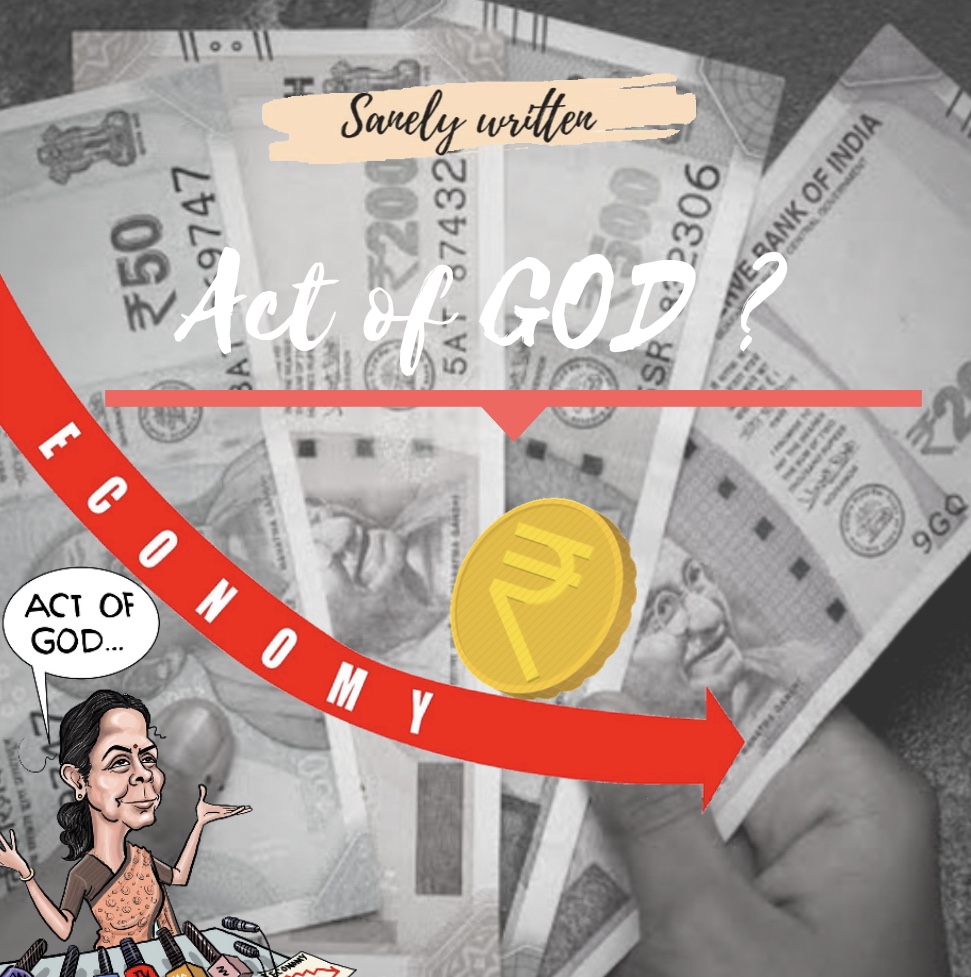

Economy, a not so trending topic but important nonetheless, has been the talk of the town these past few months, and rightly so because the whole world has been facing an economic downfall partly due to the global pandemic situation, some even had to face recession. The Indian economy recently faced a 23.9% downfall in its first quarter (i.e April-June). The country was already going down with a 5% GDP rate in the first quarter of 2019 (which was also a six-year lowest) and the countrywide lockdown due to the COVID-19 situation was like a nail in the coffin. There are certain terms that we’ve been hearing recently like GST, Fiscal Deficit, MSMEs, and not to forget, Act of God.

Is this about Diego Maradona’s ‘Hand of God’ goal from 1986?

No, this is about a self-goal that Finance Minister Mrs. Nirmala Sitharaman scored a few weeks ago when she invoked the ‘force majeure’ clause i.e calling it “an act of God” to make a case for why the Centre would not make up for the shortfall in States’ share of GST collections.

Back in 2017, when the State governments signed the GST Law, they were assured a 14 percent increase in their revenue every year, till 2022. In the case of these limits not being reached from the States’ share of tax, the Centre is supposed to fill the gap. This money comes from the compensation cess levied on sin and luxury goods such as alcohol, tobacco, and luxury cars.

This, along with the Centres’ commitment to increase revenues every year, was what brought the once opposing State governments onboard.

But recently, FM said that the Centre was unable to clear the dues of the State governments because of this pandemic, which was an act of God. This still doesn’t explain the fact as to why the compensation dues were repeatedly delayed since August 2019. All the things that happened before the lockdown increased the severity of the things that happened post lockdown leading to a complete economic disruption.

The decline in GDP numbers by 23.9% in the last quarter shows that the Indian Economy is in doldrums. Many rating agencies have raised their projections of the contraction of India’s economy in the current fiscal year. According to them, they see India’s GDP contracting more in FY21 than projected earlier.

What’s the way out?

FIRSTLY, the Indian government needs to announce a fiscal and monetary stimulus. A package similar to the one that was announced in May 2020 needs to be announced soon.

The business and the financial sector of the country must have taken a hit due to the present situation. The SMEs have been hit by a number of shocks before and to what extent is the financial sector of the country going to support the growth rate and act as a supplier of credit.

Fiscal Deficit:

Fiscal deficit means that the expenditures have been more than the income. It is an indication of the total borrowings of the Government. India has a high Fiscal deficit but that should not deter us from giving new fiscal and monetary stimulus to improve India’s GDP and growth rate.

Let’s take an example-

There is a family that is already in debt i.e its income is less than its expenses, meaning, it has a fiscal deficit. If the income of one of the family members reduces, the family will have to borrow more in order to meet the expenses thereby increasing the fiscal deficit. Suppose, if a disease is transmitted and all the surrounding families including this gets affected due to it and the income of some of the family members become Zero.

In that case, we can’t do anything but borrow more money instead of thinking about the fiscal deficit, in order to meet the family expenses. In the same way, India without thinking about the current fiscal deficit needs to chalk out a plan in order to improve the current economic situation.

DEMONETIZATION:

The ban on currency notes is being cited as one of the major factors that led to the economic slowdown. The first quarter of 2017-18 saw a GDP growth rate of 5.7% which was a three year low, the government should not have faced away from the reality of economic slowdown. The World Bank reduced the Indian GDP growth forecast to 7% owing to demonetization and GST (Goods and Service tax). The main objective of the demonetization was to curb the black money if but we look at the data, around 97% of the banned currency notes were deposited back to the banks and only 3% (around 43 trillion rupees) black money was scraped undeclared. So we can see that most of the black money of this country is not in the form of cash.

Also, the total fiscal revenue of the government from demonetization was 88,430 crores and the cost of demonetization (i.e printing the new currency notes, cost of managing the excess liquidity with banks, and also the economic contraction) was 68,900 crores. We can see that the total profit of the government was just 19,530 crores. Many countries have gone through demonetization like the USA in 1969, Australia in 1996, Germany in 1923, the Soviet Union in 1991, and apart from the USA and Australia, none were able to sustain their growth rate.

It won’t be wrong to say that the slowdown may be a delayed consequence of demonetization.

MICRO, SMALL & MEDIUM ENTERPRISES (MSMEs):

A very important role in the economy of this country is played by the MSMEs. They have contributed immensely to the country’s socio-economic development. It plays an important role in the development of the backward and rural areas of the country and generates employment opportunities. It won’t be much of a stretch to refer to them as the ‘Backbone of the economy’.

On May 13, given the fact that the MSMEs were affected badly because of the pandemic, the government proposed to offer collateral-free loans to MSMEs which will be fully guaranteed by the Centre. A principal repayment moratorium for 12 months, capping of the interest rate, and no guarantee fee were the key points of the proposal. All MSMEs with a turnover of up to ₹100 crores and with outstanding credit of up to ₹25 crores were declared eligible to borrow up to 20% of their total outstanding credit as on February 29, 2020. The scheme will be open till the 31st of October and it will be a four-year tenure.

Banks on the other hand are flushed with funds and are still unwilling to lead to these categories of borrowers because they fear that the money won’t be paid back. The government, to break this logjam has announced a package of 3 lakh crore as a backstop for the banks and have also said that these loans will need no collaterals. Now the banks are expected to be comfortable to assist the borrowers because now there is no risk as the loans are being guaranteed by the central government itself. This will be an initial seed for the small businesses that are hit by zero cash flow due to the lockdown situation. It will help them with their raw materials, initial bills, and also to pay back to the daily wage workers who have suffered the most in these times. It will act as working capital for their business. Easier said than done because there are many small businesses that wary on taking fresh loans even if the government is backing them because they are not sure of the demands that will be there for their products when they resume their business activities. MSMEs expected a different type of help from the government.

Mukesh Mohan Gupta, president of industry body Chamber of Indian MSMEs (CIMSME) said that “A direct benefit transfer (DBT) support would have helped MSMEs face the crisis better.”

“It would have been a breather for small businesses had the government taken care of their fixed expenses,” said Anil Bhardwaj, secretary-general of Federation of Indian Micro, Small & Medium Enterprises (FISME).

“Only 5-7% MSMEs will benefit out of such criteria,” said Bhardwaj of FISME.

Therefore the upcoming US presidential elections will be of great importance for the world, they were in past too, but this time World will watch it even more closely.

— Raghuram Rajan (@RaghuramRRajan) June 1, 2020

The V- shape recovery of economy is a myth in this situation because different sectors grow with different pace.

(Disclaimer - Above twitter profile is a parody account of Raghuram Rajan)

4/4

— Raghuram Rajan (@RaghuramRRajan) June 1, 2020

However difficult things may look,

"I feel disaster brings rethinking and rethinking created possibility of a better tomorrow."

Watch Full interview with @BBCHARDtalk

https://t.co/j0fmMdU9Sv

(Disclaimer - Above twitter profile is a parody account of Raghuram Rajan)

The government should ensure that the additional loan under ₹3 lakh crore is not adjusted against the overdue of the MSMEs since most of the units are in default.

In order to avoid the disaster that the Indian economy is heading towards, there has to be a massive injection of demand by the government, both through cash transfers and through direct spending on goods and services. To begin with, the Centre must hand over the goods and services tax or GST compensation that it owes to the State governments. This, apart from shoring up the economy, will fulfill its constitutional obligations.

References:

• https://www.india.gov.in/topics/finance-taxes/economy

• Demonetization and its impact on Indian Economy by Rakesh Jangid

4 replies on “Act of God?”

Really good read, you guys are doing a great job

Doing great job?

Wow.. It is a nice article.. You have focused on many things.. it’s really nice.. good going

Nicely written ?

Keep on writing ?